April 11, 2019 | Industry Insights, Trade

Fresh Tomatoes from Mexico

Will we soon see the resumption of a 23-year old investigation?

The U.S. Commerce Department’s International Trade Administration recently informed representatives of Mexico’s tomato growers the current suspension agreement would soon terminate. U.S. government officials and representative of both US and Mexico’s growers are negotiating new terms and price floors. Unfortunately, it does not appear all parties will be in agreement prior to the early-May deadline, resulting in the resumption of the 23-year old antidumping investigation.

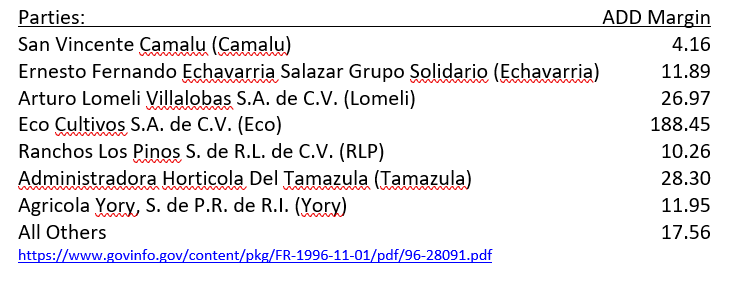

Strong indications are pointing to the end of the existing suspension agreement covering imports of Mexican fresh tomatoes. Termination of a suspension agreement, expected to occur around May 7, means the resumption of the original ADD investigation which already reached the stage of an affirmative preliminary determination and the commencement of provisional measures. Around May 7, we anticipate CBP will be instructed by Commerce to, once again, suspend liquidation of covered entries and enforce provisional measures based on the following growers’/exporters’ ADD margins:

The resumption of the investigation is as if the affirmative preliminary determination will have been published in May, 2019. It was originally published Nov 1, 1996, 23 years ago. All of the ensuing investigation deadlines (75 to 135 days for Commerce’s final determination as to the ADD margin; then 45 more days for the US ITC’s final determination as to injury) will be reset and commence upon the 2019 resumption of the investigation.

Even though the Commerce Department rewrote its regulations1 over eight years ago amending how CBP would be instructed to handle provisional measures, that regulatory action applied prospectively. Since this petition regarding fresh tomatoes from Mexico was filed in 1996 it is exempt from the 2011 rewrite of §351.205(d). However, the trade environment and posture of the present administration might mean there could be some statutory or regulatory provision that gives the Commerce Department enough discretion to deny the availability of a bond-in-lieu-of-cash option, making cash deposits the only option.

Planning ahead for the next steps:

1. Plan for an underwriting review and/or pre-approval of higher bond limits.

Roanoke encourages southern border U.S. customs brokers to contact their clients to determine those that import, or are likely to import, fresh tomatoes from Mexico. Importers need to be aware of the imminent drastic changes to current-day duty-free imports. Importers should be planning for how they will meet new import requirements, principally having to pay antidumping duties with entry summaries. Importers should also be establishing approval from surety companies for bond(s) that will soon be covering antidumping merchandise. Even importers depositing cash will undergo tighter underwriting scrutiny because of the new risk – the lag time between entry and when the estimated antidumping duties are paid. The continuous bond is what gives the importer the ability to pay estimated ADD with the entry summary, or on the monthly statement. Importers wanting to make use of STBs in lieu of cash deposits, should those be allowed, will absolutely need to obtain the surety’s approval before bonds will be issued. Customs brokers should make it a goal to get their tomato importer clients reviewed and approved prior to May 7.

Importers should be prepared to find, in insurance terminology, a “very tight” marketplace. Adding antidumping obligations to an otherwise mundane entry vastly changes the risk level to one where the general rule is that bonding must be secured dollar-for-dollar by a letter of credit from an approved bank. Exceptions to “full collateral only” requirements exist but are rare and infrequent. Exceptions usually are available only for the most financially sound firms.

2. Unpredictability and impact on continuous bonds

We can’t predict the future. Past history has shown that the parties come to terms and agree on a new suspension agreement fairly quickly. But matters could drag on. The longer provisional measures continue (up to 6 months) and after that the likely issuance of an antidumping order, the more the antidumping duties accumulate and affect CBP’s monthly bond sufficiency review. Continuous bonds must always be in an amount that is at least 10% of the previous 12 months of duties, taxes, and fees. This calculation includes the ADD, whether it’s paid in cash or secured with STBs. When this amount exceeds $500,000 in a 12 month period, the typical $50,000 continuous bond is deemed insufficient and CBP requires a higher bond amount be filed within 30 days. In situations where the bond is deemed to be significantly insufficient, CBP gives no advance notice to replace the bond. A bond designated and rendered insufficient by CBP is immediately unavailable to be used to release cargo, or allow ISF activity.

The ability to import and obtain immediate delivery of cargo will cease due to inattentiveness to bond sufficiency and/or untimely or improper handling of CBP’s bond requirements.

3. Paying by importer’s ACH – start the process early

Many customs brokers may determine that the antidumping duties being paid in cash should be paid by the importer’s own ACH arrangements with CBP, as opposed to being part of the broker’s statement. The Revenue Division of CBP, in Indianapolis, process ACH applications and they have informed Roanoke Trade that these applications are taking 12-15 business days to process. They are also experiencing a rejection rate of around 40%, so please double check and ensure the ACH application is complete. CBP always requires the ACH bank to be located in the U.S. If your client has established ACH in the past, but hasn’t used it in a while, you should reconfirm its functionality with the Revenue Division in Indianapolis.

4. Paying on daily or monthly statements.

Antidumping duties are eligible for either daily or monthly statement processing. CBP reminds the trade that ACH means they will be pulling the statement amount from the bank account, and if the account has a limit on how much can be pulled by ACH, parties should ensure the limit is large enough to cover every statement amount. When payment is not honored, all entries on the statement are considered unpaid and become the subject of liquidated damages, and a low ACH limit causing the payment delay can be considered an aggravating factor (not good!) during the mitigation process.

5. Other ADD-related matters

Non-reimbursement certification(s) must be on file in ACE. Importers that fail to certify there is no reimbursement, or agreement to reimburse, incur the statutory requirement of paying double the amount of ADD.

Be cautious of selecting the proper ADD rate for importers purchasing from exporters that are not the growers. In these reseller situations, the original grower’s sale to the exporter might not be reported as a US transaction during an annual administrative review. If the exporter does not have its own separate ADD rate, Commerce will instruct CBP to use the “all others” rate at liquidation, which is often much higher than an individual grower’s rate used at the time of entry. This often results in a substantially large bill years after the goods were imported, priced, and paid for.

Where tomatoes are entered, but rejected or are sorted into a low-demand category or are unsellable, ADD could still be due on these products. Drawback is never allowed on ADD/CVD.

Entries of merchandise subject to antidumping and countervailing duties are unlike typical commercial entries. The bonds used for ADD/CVD entries involve different underwriting rules. ADD/CVD entries take many years to liquidate, and often result in liability for additional duties long after the imports are priced and sold.

As much attention and focus Roanoke applies and the tighter underwriting requirements for ADD/CVD importers, about 30% of every dollar paid in losses under our bonds arises from ADD/CVD. Over the past decade or so, other sureties, especially those that catered to providing STBs in lieu of cash deposits, paid or incurred well over $100 million for ADD/CVD-related matters. Bonds for importers of ADD/CVD merchandise are considered extremely risky and require different underwriting standards than what most customs brokers and importers experience.

Please don’t hesitate to contact your local Roanoke Trade bond team with any questions you may have, especially when they involve the importation of merchandise subject to ADD/CVD.

This information is intended to provide the reader with a high-level perspective of very technical events and regulations. Every possible situation cannot be summarized; nuances and details can vary from person to person and matters should be thoroughly researched in order to plan for the specific impact of these events in each situation.

About Roanoke Trade

Roanoke Trade is the leading provider of insurance and surety solutions for transportation and logistics providers. Established in 1935 and recognized as the most reliable source for U.S. customs bonds, we were the first company in the United States to serve the needs of customs brokers and their clients. Our mission has always been – and continues to be – to set the industry standard in delivering quality insurance, surety and risk management services to those businesses involved in importing, exporting or transporting goods.

Roanoke Trade is a subsidiary of Munich Re and an affiliate of the Munich Re Syndicate, Ltd., the leading syndicate underwriting transportation risks at Lloyd’s of London.

We’re strategically represented in ten cities throughout the United States and hold appropriate resident and non-resident insurance licenses in all 50 states and in the District of Columbia.